-

Clients We Help

-

Who We Serve

- Global Entrepreneurs & Business Leaders

- Family Investors & Legacy Planners

- Digital Nomads & Global Professionals

- High-Risk & Uncertain Environments

- Tax Optimisers & Wealth Preservers

-

How We Help

- Personalised Advisory

- Expert Guidance

- Comprehensive Support

- Global Network

-

-

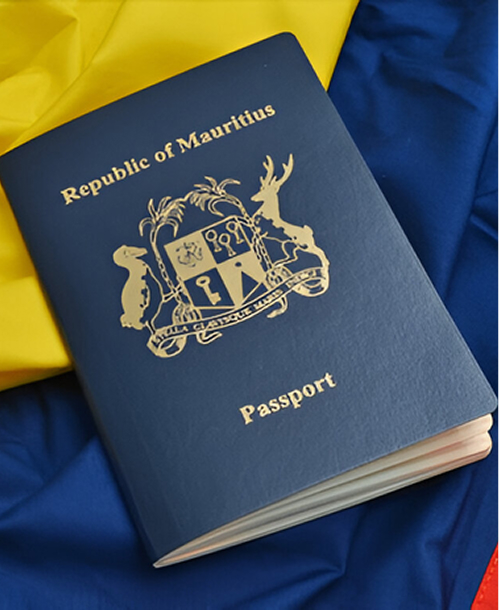

Citizenship

-

Caribbean

-

Europe

-

Middle East & Africa

-

Oceania

-

-

Residency

-

Asia

-

North America

-

Africa

-

Services

-

Tax Advisory

Trusted partners specialising in cross-border taxation and asset protection.

-

Sovereignty Without Borders

We believe in the transformative power of second citizenship, strategic residency, and effective global mobility.

-

Ongoing Support & Compliance

Our commitment does not end when you receive your new passport or residency permit.

-

Multi-Jurisdictional Planning

For those managing multiple residencies or contemplating a change in their domicile for business expansion, lifestyle, or retirement.

-